Insert every amount month-wise from Jan to Dec. In this section, insert the income from all sources such as salary, external projects, interest income, rent, etc. You need to only enter the monthly amount and it will automatically multiply it with 12 for getting the yearly amount. There are two columns for each head one is monthly and another is yearly. It is better to save first and then spend what is left behind rather than saving what is left behind after spending. Insert the desired amount against the respected column. You can plan a monthly amount for each purpose and a yearly average of savings that you want to make. The saving planner consists of the purpose of savings such as long term, holidays, mortgage, purchase of a car, motorbike, etc. Contents of Saving Goal Tracker Excel Template

Let us discuss the contents of the template in detail.

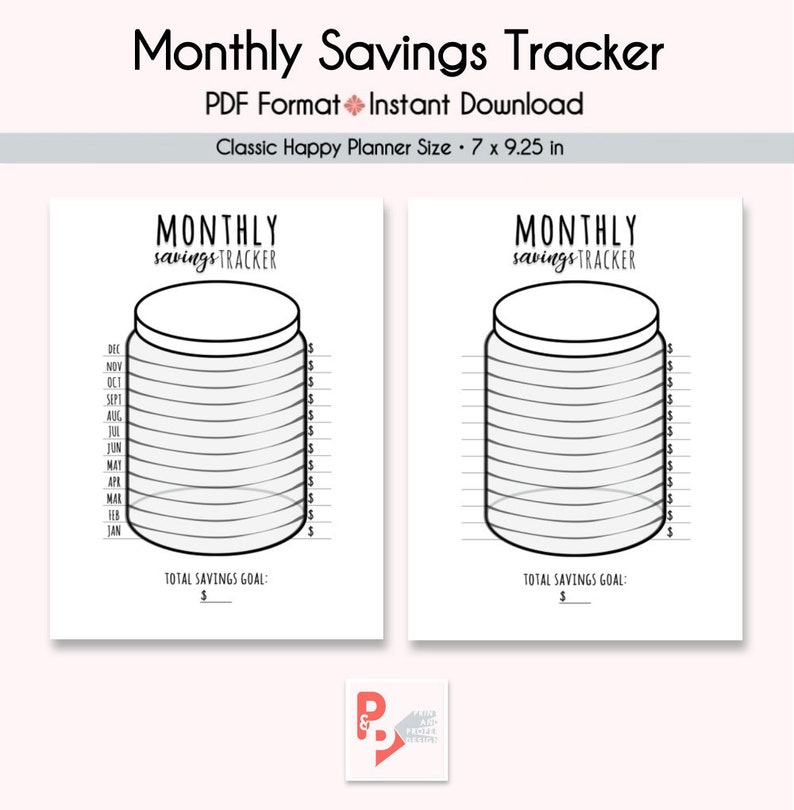

MONTHLY SAVINGS PLANNER DOWNLOAD

You can download other financial analysis templates like Credit Card Payoff Calculator, Savings Goal Tracker, Income Tax Calculator FY 2018-19 and Loan Amortization Template. Click here to Download All Personal Finance Excel Templates for ₹299. We have created a simple and easy Saving Goal Tracker Template to manage your income-expenses, plan your savings goals and track the progress of your saving goals.Ĭlick here to download Savings Goal Tracker Excel Template.

It also helps you to keep a track of the amounts deposited for each purpose every month.įurthermore, it also displays the difference between your income and expense and the deficit amount to fulfill your savings goals. Additionally, it helps you to plan a monthly amount to spare for multiple purposes.

0 kommentar(er)

0 kommentar(er)